2024 Fsa Contribution Limits Over 65

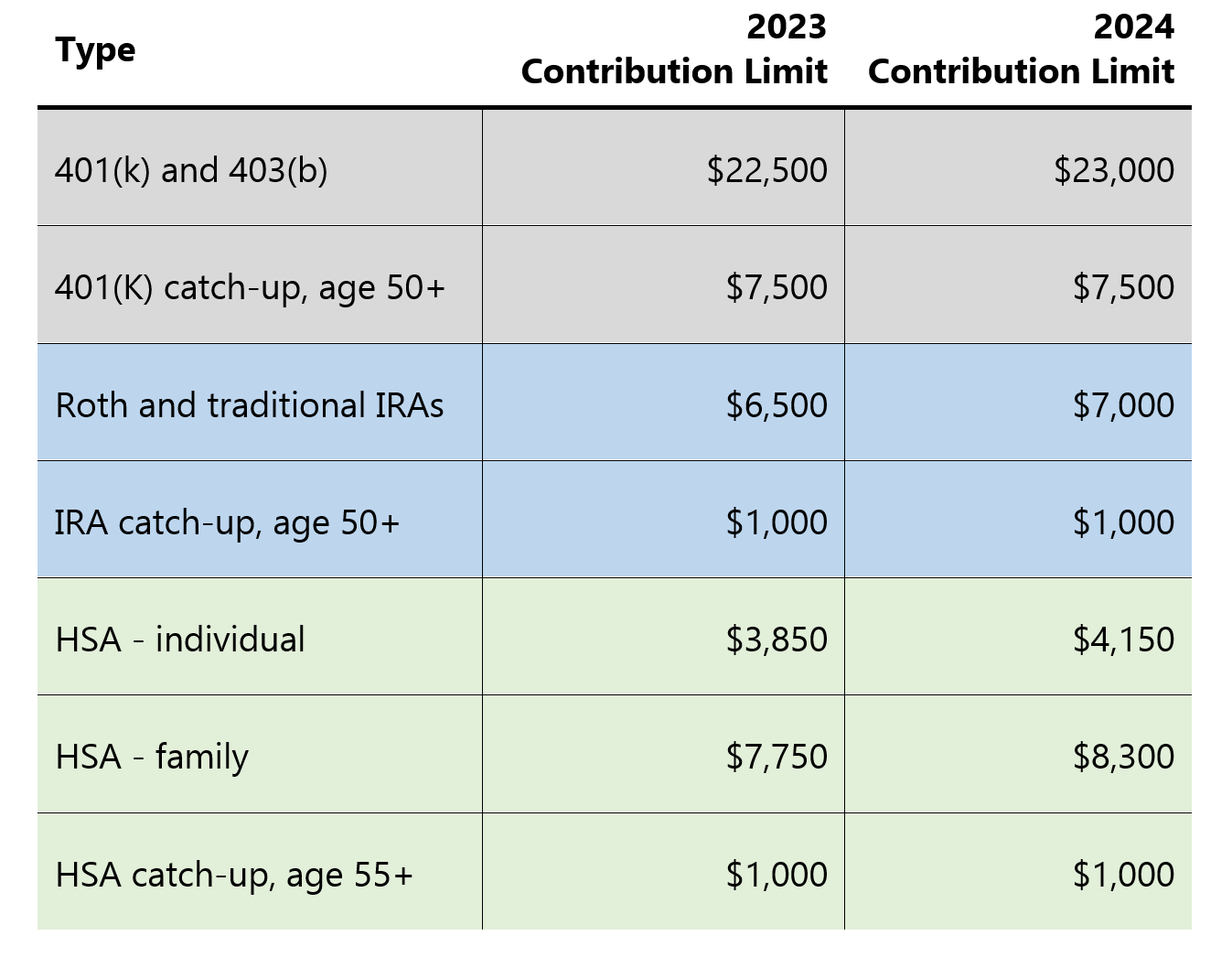

2024 Fsa Contribution Limits Over 65. The irs has recently disclosed adjustments to contribution limits for 2024, bringing some changes to both fsas and hsas. Fsa contribution limits cap the amount of money you can contribute to your fsa each year.

For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2024 is $640. Individuals can contribute up to $4,150 to their hsa accounts for 2024, and families can contribute up to $8,300.

Dependent Care Fsa 2024 Contribution Limits Over 65 Merry Stormie, The hsa contribution limit for family coverage is.

2024 Fsa Contribution Limits Over 65 Cassy Dalenna, Employers should take proactive steps to ensure compliance.

Dependent Care Fsa Contribution Limit 2024 Over 65 Minny Tamarah, Amounts contributed are not subject to.

IRS Announces 2024 Increases to FSA Contribution Limits SEHP News, Learn what the maximum fsa limits are for 2024 and how they work.

2024 Dependent Care Fsa Limits Over 65 Haley Keriann, In 2024, the fsa contribution limit is $3,200, or roughly $266 a month.

What Is The Maximum Fsa Contribution For 2024 Over 65 Vinni Jessalin, Learn what the maximum fsa limits are for 2024 and how they work.

Dependent Care Fsa Limits 2024 Over 65 Viole Suzette, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2024 plan year.

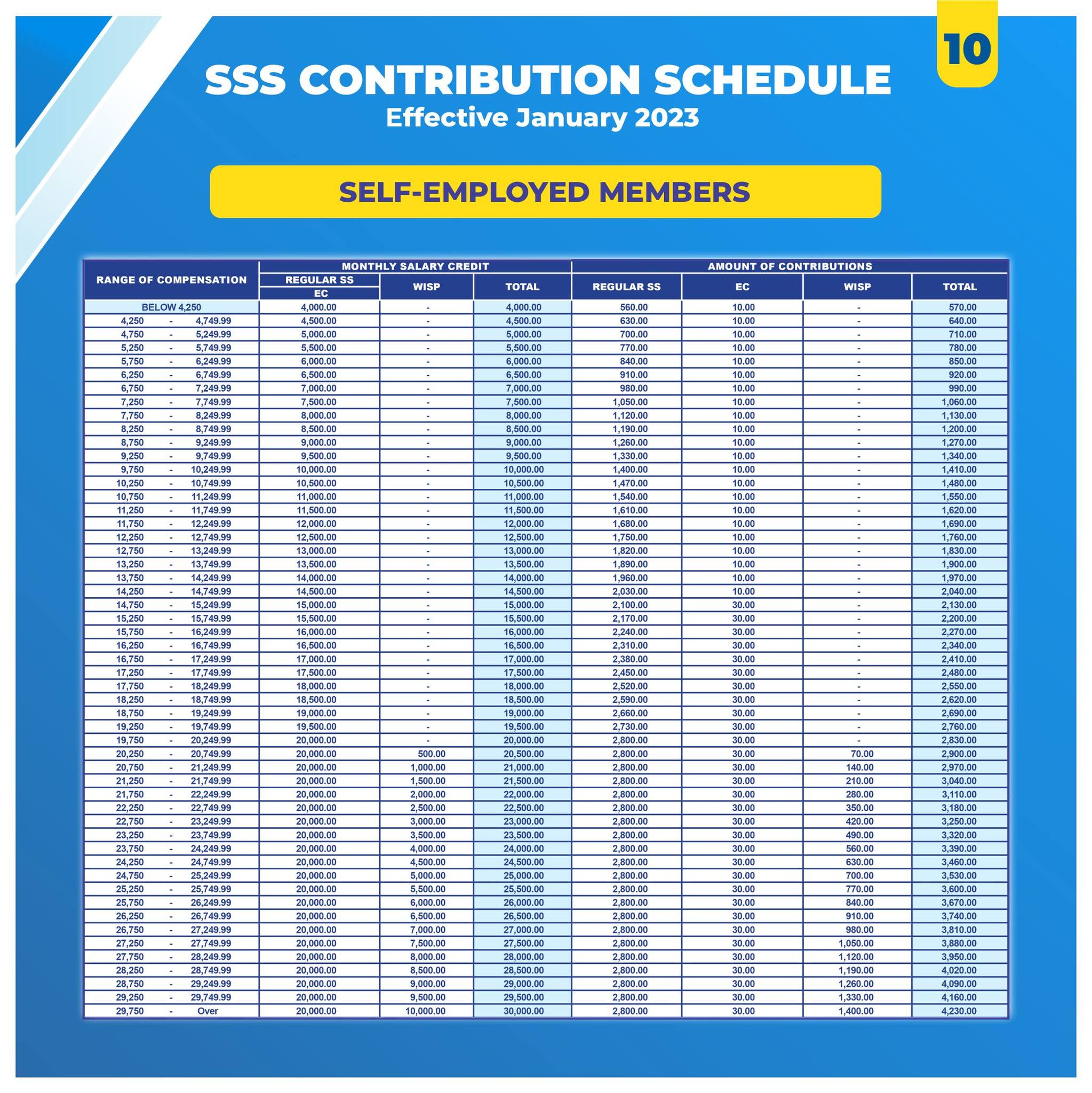

Family Fsa Contribution Limit 2024 Vicky Marian, We call this annual limit the contribution and benefit base.

2024 Fsa Contribution Limits Family Members Heath Koressa, The tax year 2024 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.